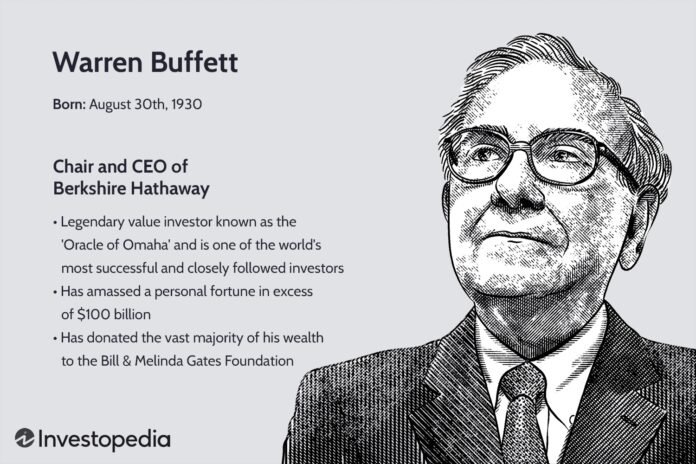

Warren Buffett, widely regarded as the “Oracle of Omaha,” is not only one of the most successful investors in history but also a deeply principled businessman and philanthropist. His life story is one of perseverance, a disciplined investment philosophy, and a personal commitment to simplicity and generosity. Buffett’s journey from a young boy with a keen interest in numbers to becoming one of the world’s richest men is as remarkable for his personal choices as it is for his financial achievements. In this detailed article, we will explore his life, his investment strategies, and the unique aspects of his personal life that have shaped him.

Early Life: The Beginning of a Financial Genius

Born on August 30, 1930, in Omaha, Nebraska, Warren Edward Buffett grew up during the Great Depression. He was the second of three children and the only son of Howard Buffett, a stockbroker and later a U.S. congressman, and Leila Stahl Buffett, a homemaker. From an early age, Buffett showed an unusual interest in numbers and business. His entrepreneurial spirit began to emerge when he started selling chewing gum, Coca-Cola, and magazines door-to-door in his neighborhood.

One of Buffett’s early influences was a book he discovered at the age of seven called One Thousand Ways to Make $1,000. The book sparked his lifelong fascination with the stock market and making money. By the time he was 11, Buffett had already bought his first shares of stock: Cities Service Preferred, which he purchased for himself and his sister Doris. This early investment taught him a crucial lesson about patience, as the stock initially dropped in value before recovering. This would become a cornerstone of his investment philosophy.

Buffett’s childhood was also marked by other small business ventures. In high school, he and a friend purchased a used pinball machine for $25, placing it in a local barbershop. The machine became a hit, and soon they expanded the business to several locations. By the time he graduated, Buffett had saved nearly $10,000 from his various ventures—an impressive feat for a teenager at the time.

Education and Early Career: Learning from the Masters

Although Buffett was ready to dive straight into business after high school, his father insisted that he attend college. Warren enrolled at the Wharton School of the University of Pennsylvania, but after two years, he transferred to the University of Nebraska, where he completed his Bachelor of Science in Business Administration at the age of 19. Despite his initial reluctance to pursue formal education, Buffett recognized the value of learning from experts in his field.

Buffett’s life took a pivotal turn when he was introduced to the works of Benjamin Graham, a professor at Columbia Business School and author of The Intelligent Investor. Inspired by Graham’s value investing philosophy, which emphasized buying stocks at prices below their intrinsic value, Buffett enrolled at Columbia Business School to study under Graham. He earned his Master of Science in Economics in 1951, a degree that would form the foundation for his future investment strategy.

After graduating, Buffett worked at his father’s brokerage firm, Buffett-Falk & Co., and later for Graham-Newman Corp., where he gained invaluable experience as a securities analyst. However, despite his success in New York, Buffett returned to Omaha in 1956 to start his own investment firm, Buffett Partnership Ltd. With an initial capital of $105,000 from family and friends, Buffett applied the principles he had learned from Graham to build a small fortune over the next few years.

Buffett Partnership Ltd. and the Acquisition of Berkshire Hathaway

By the time he was in his early 30s, Warren Buffett had established himself as a shrewd investor through his partnerships. In 1962, he made one of the most important decisions of his career when he began buying shares in Berkshire Hathaway, a struggling textile company. Buffett initially saw the company as an undervalued stock play, but as he bought more shares, he eventually took control of the company in 1965.

At first, Buffett attempted to turn the textile business around, but it became clear that the industry was in decline. Instead of continuing to focus on textiles, Buffett began using Berkshire Hathaway as a holding company to invest in a wide range of industries, from insurance to utilities to consumer goods. One of his earliest and most significant acquisitions was GEICO, an insurance company that became one of Berkshire’s cornerstone investments.

Over time, Berkshire Hathaway evolved into a diversified conglomerate, owning or holding significant stakes in companies like Coca-Cola, American Express, Apple, and BNSF Railway. Buffett’s investment strategy—buying strong businesses at a fair price and holding them for the long term—proved to be incredibly successful, making Berkshire Hathaway one of the most valuable companies in the world.

Personal Life: Humility, Simplicity, and Relationships

Despite his immense wealth, Warren Buffett is known for his simple lifestyle and down-to-earth personality. Unlike many billionaires who indulge in luxury, Buffett has remained humble. He still lives in the same house in Omaha that he purchased in 1958 for $31,500, and he drives himself to work in a modest car. His diet is famously simple as well, consisting largely of Coca-Cola, McDonald’s, and ice cream—treats he has enjoyed for decades.

Buffett’s personal life has been shaped by his deep relationships with his family and close friends. He married Susan Thompson in 1952, and they had three children: Susan Alice, Howard Graham, and Peter Andrew. Although the couple began living separately in 1977, they remained close until Susan’s death in 2004. In 2006, Buffett married Astrid Menks, who had been a companion of the family for many years. Susan had even introduced Astrid to Warren before she moved to San Francisco to pursue a singing career, a reflection of their unusually close and supportive relationship.

Buffett’s relationship with his children is unique as well. He has famously said that he will not leave his children a significant inheritance, believing that they should earn their own success. However, Buffett has supported their endeavors in other ways, helping them develop their own philanthropic efforts through family foundations.

Philanthropy: The Giving Pledge and Lifelong Generosity

Warren Buffett’s commitment to giving away his fortune is as well-known as his investing acumen. In 2006, he made headlines when he pledged to give away 99% of his wealth, primarily through the Bill & Melinda Gates Foundation. This act of generosity was followed by his co-founding of The Giving Pledge with Bill Gates in 2010, an initiative that encourages billionaires to commit to donating at least half of their fortunes to charity.

Through his personal foundation, the Susan Thompson Buffett Foundation, named after his late wife, Buffett has supported causes ranging from reproductive health to education scholarships. His children have also followed in his philanthropic footsteps, each establishing their own charitable foundations with his support.

Buffett has said that he believes those who benefit most from society have a responsibility to give back. His philanthropy is guided by a sense of fairness and social justice, and he has used his platform to advocate for policies that reduce income inequality and improve the lives of the less fortunate.

Warren Buffett’s Legacy: A Life of Purpose and Success

Warren Buffett’s life is a testament to the power of patience, discipline, and ethical leadership. His investment strategy, centered around value investing and long-term growth, has earned him billions, but his humility and commitment to philanthropy have earned him something far more valuable—respect and admiration from people around the world.

Buffett’s story is not just about financial success but about living a life guided by principle. Whether in his investment decisions, his personal relationships, or his philanthropic efforts, Buffett has remained true to the values of simplicity, hard work, and giving back. His legacy will undoubtedly endure, not only as one of the greatest investors in history but as a man who used his wealth and influence to make the world a better place.

As Warren Buffett continues to lead Berkshire Hathaway and contribute to charitable causes, his influence on the business world and society at large will remain a source of inspiration for future generations. His life is a powerful reminder that success is not just about making money—it’s about using that success to create positive change.